Irs Form 1041 Schedule G 2024 – The due date to file an updated Income Tax Return (ITR-U) for 2021-22 is declared as 31st March 2024. The Income Tax Department of India has tweeted to alert the taxpayers regarding the approaching . But last year, the IRS delayed the $600 tax reporting rule for payment apps, meaning that similar to prior years, users of cash apps would only receive a 1099-K tax form if they made $ threshold .

Irs Form 1041 Schedule G 2024

Source : www.irs.gov

What is a Schedule K 1 Form 1041: Estates and Trusts? TurboTax

Source : turbotax.intuit.com

3.12.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.gov

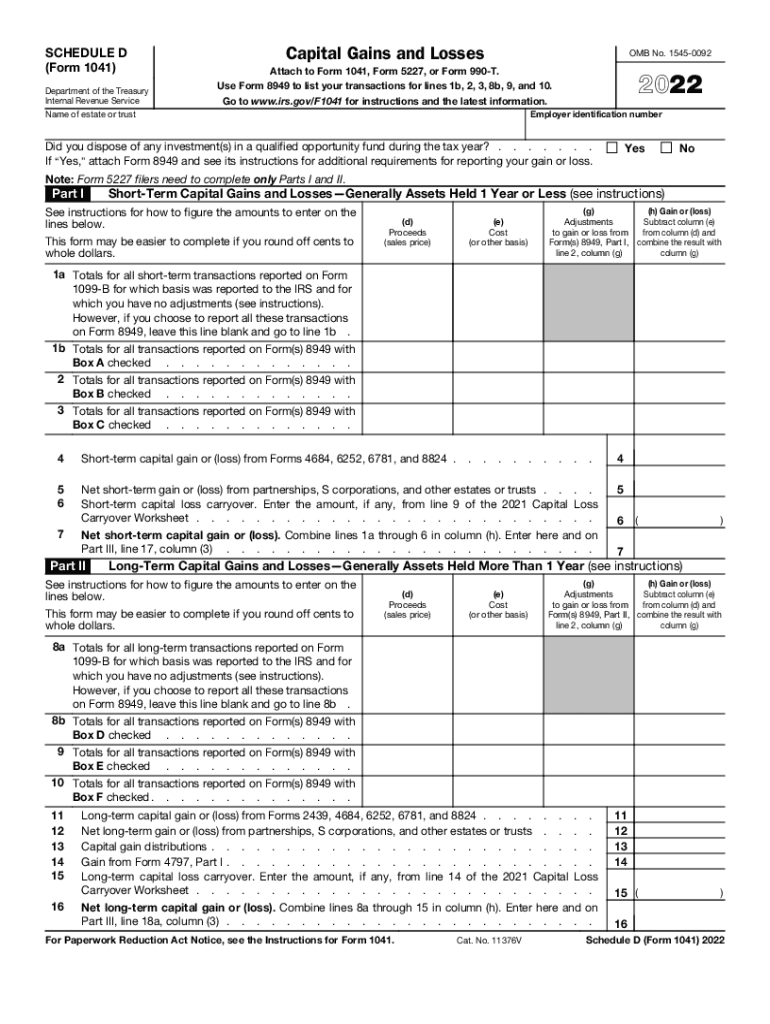

2022 Form IRS 1041 Schedule D Fill Online, Printable, Fillable

Source : form-1041-schedule-d.pdffiller.com

3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.gov

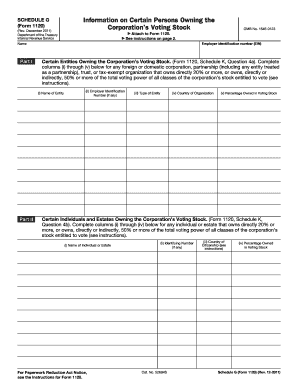

2011 2023 Form IRS 1120 Schedule G Fill Online, Printable

Source : 1120-schedule-g.pdffiller.com

3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.gov

REG: Federal Tax Procedures and Tax Penalties:Simple Trust vs

Source : www.youtube.com

3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.gov

Form 1041 U.S. Income Tax Return for Estates and Trusts Form 1041

Source : www.slideshare.net

Irs Form 1041 Schedule G 2024 3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041 : That means people who receive more than $5,000 in payments via PayPal and other apps in 2024 would receive the 1099-K tax form in early 2025 to complete their 2024 tax returns. For the 2025 tax . But last year, the IRS delayed the $600 tax reporting rule for payment apps, meaning that similar to prior years, users of cash apps would only receive a 1099-K tax form if they made $20,000 in .